In essence, Doji is a key trend reversal pattern. In candlestick chart trading, the Doji pattern is one of the most visible reversal signals in the market. Moving forward, you’re going to learn the different types of Doji patterns, what a Doji candlestick is, and how they can help you make more informed trading decisions. As a retail trader, you need to step up your game and we’re here to facilitate that road for you. You need a well-detailed trading plan to face the smart money aka hedge fund managers and institutional investors. Trading Doji candlestick as a stand-alone trigger signal is a bad idea.

If you want a reliable Japanese candlestick strategy, you’ll need a more sophisticated trading approach. That’s the reason why sometimes it’s referred to as a Doji Star.

#Long legged doji plus

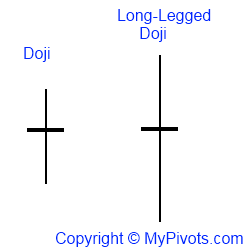

The Doji strategy makes use of a very small Japanese candlestick pattern that has a similar appearance of a plus sign or a cross.

#Long legged doji free

Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly to your email. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. This will be a great introduction into different types of Doji, and also a great candlestick pattern strategy that will help you trade as fast as the market changes. As with most things, not all price patterns are created equal and the Doji candlestick has its own features. Learning to trade with candlesticks can help you improve your trading outcomes and trade with a greater sense of precision. The best Doji strategy can help you isolate the trade with a very simple Japanese candlestick pattern.

0 kommentar(er)

0 kommentar(er)